Deal Dosti Markets

_0_1%20(1).png)

DEAL DOSTI MARKETS

start your investment journey!

It's EASY and STRESS-FREE!

What is Deal Dosti Markets?

Open An Free Demat Account - a step-by-step guide that aids your stock market journey from the very first step- is a friendly approach by Dealmoney to introduce you to the world of the stock market

DDM Features:

- FREE Demat + Trading account

- ZERO Brokerage for First Month

- FREE AMC for the First Year

- Trade at Flat ₹15 per lot

- Low Brokerage for Intraday and delivery trades

- Single platform for stocks, MFs, IPOs, EFTs, and more!

- *# To know about the terms and conditions, product, rewards, and scheme, Click here.

How Does 'Deal Dosti Markets' Work For You?

Open Demat and Trading Account

Commence your Trading Journey

Why Dealmoney

CROSS-PLATFORM TRADING

PAPERLESS ACCOUNT OPENING

TECH YOU CAN TRUST

TEAMWORK

What Is demat account

A Demat Account, also known as a Dematerialised Account, allows you to keep shares and securities in an electronic format. Shares are purchased and stored in a Demat Account while online trading, making it easier for customers to trade. A Demat Account holds all of an individual's investments in stocks, government securities, exchange-traded funds, bonds, and mutual funds.

Demat enabled the digitisation process of the Indian stock trading market and enforced better governance by SEBI. In addition, the Demat account reduced the risks of storing, theft, damage, and malpractices by storing securities in electronic format. It was first introduced in 1996 by NSE. Initially, the account opening process was manual, and it took investors several days to get it activated. Today, one can open a Demat account online in 5 mins.

Steps to apply

Verify Personal Details

Self KYC

e-Sign

THINK OF US LIKE

THE SUPERMARKET OF FINANCE

Get everything under one umbrella

Stocks & IPOs

Futures & Options

Mutual funds & ETFs

Currency & Commodity

Screener

Market Research

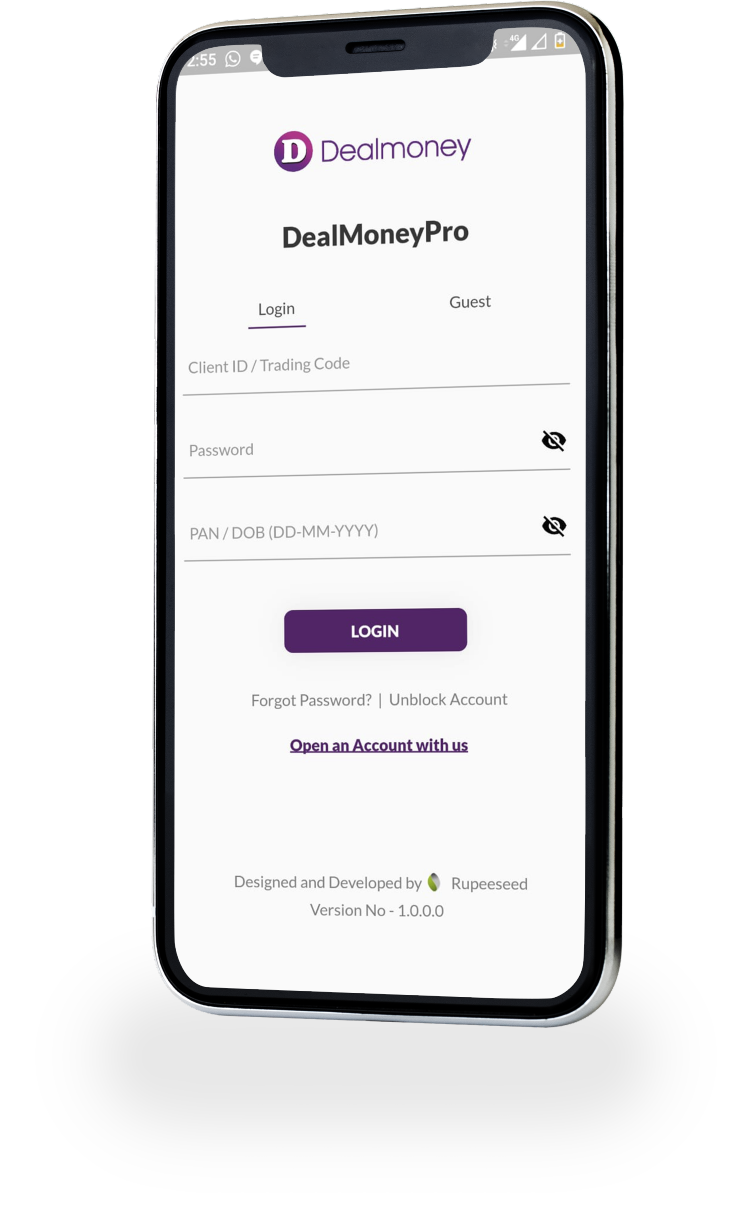

DOWNLOAD DEALMONEY PRO APP

FREQUENTLY ASKED QUESTIONS

A Demat account is a necessary account to hold financial securities in a digital form and to trade shares in the share market.

Dealmoney has a simple onboarding process. You need to share the following information: Proof Of Identity (PAN Card, Aadhaar, Driving Licence), proof of address, and your bank details.

The difference between a demat and a trading account is that a demat account holds the shares and securities (bonds, ETFs, mutual fund units, etc.) in digital mode, while a trading account provides the interface to buy and sell shares in the stock market.

Any individual who is a resident of India and 18 years old or above is eligible for opening a demat account, provided he/she has a PAN card.

The following is the process of transfer of shares from one Demat account to another in brief.

- Step 1 - The investor fills the DIS (Delivery Instruction Slip) and submits it to the current broker.

- Step 2 - The broker forwards the DIS form or request to the depository.

- Step 3 - The Depository will transfer your existing shares to the Demat account.

- Step 4 - Once all the shares are transferred, the same will be reflected in the investor’s new Demat account

Yes, a person can hold more than one Demat Account as long as they are all linked to a single PAN.

Dealmoney Commodities Private Limited (Formerly known as Dealmoney Securities Private Limited)